The rapid evolution of the digital marketplace has opened up new avenues for entrepreneurs, allowing you to efficiently tap into a global customer base. However, this borderless business landscape also presents unique tax challenges. Sales tax considerations, cross-border issues, and the sheer complexity of tax laws demand careful planning. Here’s a comprehensive guide to help e-commerce businesses navigate the complex world of taxes and seize growth opportunities.

The E-Commerce Landscape

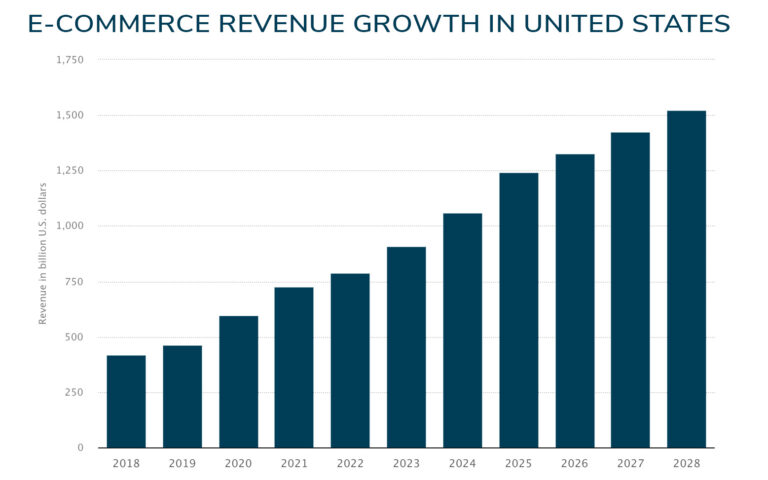

Over the past five years, revenue from e-commerce has nearly doubled. With 2023 estimated to be almost 1 trillion dollars in revenue. And growth isn’t slowing down any time soon. By 2028, revenue from e-commerce is estimated to surpass $1.5 trillion. This massive figure underscores the crucial role of the Internet in modern business, making it a competitive advantage for the United States. Yet, the Internet economy is still in its infancy, with much potential to explore.

However, as e-commerce continues to grow and more businesses turn to e-commerce as a primary or secondary sales channel, the complexity of navigating sales taxes is growing more complicated. Since South Dakota v. Wayfair, a 2018 Supreme Court Ruling, sales taxes have grown significantly more complex, and you can no longer base your tax obligations solely on physical presence. If your online store racks up enough sales in another state, congratulations, you’re probably on the hook for collecting their taxes.

South Dakota v. Wayfair

In the case of South Dakota v. Wayfair, Inc. (2018), the primary issue revolved around collecting sales tax on online purchases. The State of South Dakota passed a law requiring out-of-state sellers to collect and remit sales tax on sales made to South Dakota residents, even if the sellers did not have a physical presence (such as a brick-and-mortar store) in the state.

Wayfair, an online retailer, challenged the constitutionality of South Dakota’s law, arguing that it violated the Commerce Clause of the U.S. Constitution. The Commerce Clause grants Congress the power to regulate commerce among the states and prohibits states from unduly burdening or discriminating against interstate commerce.

The Supreme Court, in a 5-4 decision, ruled in favor of South Dakota. The majority opinion, written by Justice Anthony Kennedy, held that the physical presence rule, which had previously been established in Quill Corp. v. North Dakota (1992), was outdated in the age of e-commerce. The Quill decision required a business to have a physical presence in a state before that state could compel the business to collect and remit sales tax.

In overturning Quill, the Court determined that the physical presence rule created a tax advantage for remote sellers over their brick-and-mortar counterparts, resulting in an undue burden on states and an unfair advantage for online retailers. The Court concluded that South Dakota’s law, with its threshold for economic nexus rather than physical presence, was a reasonable and constitutional way to address the challenges posed by e-commerce and the changing landscape of retail transactions. This decision opened the door for other states to enact similar laws requiring online retailers to collect and remit sales tax, even without a physical presence in the state.

Taxing Complexity of E-Commerce

Since South Dakota v. Wayfair introduced ‘economic nexus, ‘ business owners must scramble. Calculating owed taxes isn’t about geography anymore; it is about numbers – dollar figures and transaction counts that could make or break your obligation to remit sales tax.

Taxing e-commerce transactions is no simple task, mainly due to the following factors:

- Multiple Tax Jurisdictions: With around 30,000 tax jurisdictions, ensuring compliance can be an arduous task. The Internet’s borderless nature makes it susceptible to multiple and discriminatory taxation, leading to inevitable instances of double taxation.

- Tax Collection Mechanism: Compliance and tax collection costs can be a significant hurdle for small businesses. For instance, a study by Ernst and Young revealed that compliance costs for small businesses can be as high as 87% of the sales tax they collect.

- Identifying Tax Jurisdiction: Another major challenge is identifying the state or countries with tax jurisdiction over income generated by electronic transactions. The Internet allows foreign individuals to engage in multiple business transactions with U.S. customers without ever entering the country.

Economic nexus legislation is essentially the invisible tripwire in each state that determines whether you’ve done enough business there through revenue or transactions to owe them taxes.

Sales Tax Considerations

Sales tax is a primary concern for e-commerce businesses. Unlike traditional businesses, online retailers make sales across multiple states and jurisdictions and, therefore, need to understand the tax laws of each.

The process of e-commerce sales tax compliance involves several steps, including determining where you have a sales tax nexus, figuring out if your products are taxable, registering for a sales tax permit, setting up sales tax collection on your online shopping cart, reporting and remitting your sales tax, and filing your sales tax returns.

Many e-commerce platforms, such as Shopify, will automate charging sales tax. However, they won’t remit or file taxes for you. As determining your tax liability depends on whether or not you have a sales tax nexus with a particular state. Additionally you will need to register with the state or local jurisdiction if you do have nexus.

Understanding Sales Tax Nexus

Understanding the nexus in taxation is critical for any business making waves across state lines. With over 3,000 jurisdictions nationally, it’s impossible to cover all jurisdictions here, but I will cover each state broadly below. For your unique tax situation, speak with a tax professional as registration deadlines and qualifications for nexus vary greatly across jurisdictions. For example some states require registration immediately upon hitting the nexus threshold, others require registration in January the following year, still others, like Connecticut have set their measurement date as the12-month period ending on September 30.

Alabama

Sourcing: Destination

Local Taxes: Yes

Threshold: $250,000 with specific conditions

Alabama is classified as a destination state but is also defined as a home rule state. Local jurisdictions may have varying tax rules and registration requirements. Remote sellers without a physical presence in Alabama can participate in the Simplified Seller Use Tax (SSUT) program.

Alaska

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Alaska has no state sales tax but is defined as a home rule state. Some local jurisdictions may charge a destination-based rate if the seller has nexus in that state. Remote sellers can use the Alaska Remote Seller Sales Tax Commission (ARSSTC) Uniform Code to register and collect taxes in certain jurisdictions.

Arizona

Sourcing: Origin

Local Taxes: Yes

Threshold: $100,000

Out-of-state sellers with nexus in Arizona may need to register with local jurisdictions and charge destination taxes. Arizona has a single system for registering and filing taxes in most jurisdictions.

Arkansas

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

California

Sourcing: Hybrid

Local Taxes: Yes

Threshold: $500,000

California uses a mixture of origin and destination sourcing rules. Sellers can choose whether to charge taxes on shipping based on their tax registration information. It's crucial to consult with US state tax authorities or a local tax professional for accurate guidance.

Colorado

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Colorado is a home rule state, and local jurisdictions may have varying tax rules. Sellers can choose whether to charge taxes on shipping. Effective July 1, 2023, merchants can decide whether to collect the Retail Delivery Fee from customers.

Connecticut

Sourcing: Destination

Local Taxes: No

Threshold: $250,000 and 200 transactions

Connecticut is a destination state with no local taxes

Delaware

Sourcing: Not applicable

Local Taxes: No

Threshold: Not applicable

Delaware does not charge sales tax.

District of Columbia

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 or more separate retail sales

Florida

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Remote sellers in Florida can choose whether to charge taxes on shipping. Economic nexus tax laws came into effect in Florida on July 1, 2021.

Georgia

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Hawaii

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Hawaii's Gross Excise Tax (GET) applies to businesses engaged in certain activities within the state. Sellers should understand the unique tax rules in Hawaii and consult with state tax authorities or a local tax professional.

Idaho

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Illinois

Sourcing: Origin

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Illinois follows origin sourcing rules for in-state sales and destination sourcing for out-of-state sales. Sellers should choose whether to charge taxes on shipping based on their tax registration information.

Indiana

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

Iowa

Sourcing: Hybrid

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Kansas

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Kentucky

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Louisiana

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Louisiana is generally a destination state with some specific rules for jurisdictions. Sellers can use simplified registration and reporting for remote sales.

Maine

Sourcing: Destination

Local Taxes: No

Threshold: $100,000

Maryland

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

Massachusetts

Sourcing: Destination

Local Taxes: No

Threshold: $100,000

Massachusetts exempts clothing products under $175 from state sales tax. Sellers should set up tax overrides for qualifying items.

Michigan

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

Minnesota

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Minnesota has expanded the definition of a "retailer maintaining a place of business in this state" to encompass a retailer with storage in Minnesota, an employee working from a home office in the state, or a marketplace provider or third party operating in Minnesota under the retailer's authority for various purposes.

Mississippi

Sourcing: Origin

Local Taxes: Yes

Threshold: $250,000

Missouri

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Missouri e-commerce nexus laws came into effect January 1, 2023 making Missouri the final state that collects a state-wide sales tax to pass a law imposing sales tax on remote sales

Montana

Sourcing: Not applicable

Local Taxes: No

Montana does not charge sales tax.

Nebraska

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

Nevada

Sourcing: Origin

Local Taxes: No

Threshold: $100,000 or 200 transactions

Nevada follows origin sourcing rules for in-state sales and destination sourcing for out-of-state sales. Sellers should choose whether to charge taxes on shipping based on their tax registration information.

New Hampshire

Sourcing: Not applicable

Local Taxes: No

New Hampshire does not charge sales tax.

New Jersey

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

A remote seller meeting the economic threshold but exclusively using online marketplaces must register. They can opt for non-reporting as New Jersey mandates marketplace facilitators to collect tax on all transactions for marketplace sellers.

New Mexico

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

New York

Sourcing: Destination

Local Taxes: Yes

Threshold: $500,000 and 100 transactions

New York uses quarters to determine tax liability that differ from other jurisdictions. Tax quarters in New York are the following:

- March, April, and May

- June, July, and August

- September, October, and November

- December, January, and February

North Carolina

Sourcing: Origin

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

North Dakota

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Ohio

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Oklahoma

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 in aggregate sales of TPP

Oklahoma excludes marketplace sales where marketplace collects tax.

Oregon

Sourcing: Not applicable

Local Taxes: Yes

Oregon does not charge sales tax.

Pennsylvania

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Rhode Island

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

South Carolina

Sourcing: Origin

Local Taxes: Yes

Threshold: $100,000

South Dakota

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Tennessee

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Tennessee is classified as a destination state but is also defined as a home rule state. Local jurisdictions may have varying tax rules and registration requirements. Remote sellers without a physical presence in Tennessee can participate in the Tennessee Certified Service Provider (CSP) program.

Texas

Sourcing: Destination

Local Taxes: Yes

Threshold: $500,000

Utah

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Vermont

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

Virginia

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Washington

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

West Virginia

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000 or 200 transactions

Wisconsin

Sourcing: Destination

Local Taxes: Yes

Threshold: $100,000

Wyoming

Sourcing: Destination

Local Taxes: No

Threshold: $100,000 or 200 transactions

As businesses navigate the complexities of these evolving tax regulations, enlisting the services of knowledgeable and experienced professionals becomes crucial. Hiring a Certified Public Accountant (CPA) such as Prep Tax Smart can provide invaluable assistance in understanding and complying with the diverse sales tax requirements across different states. A CPA with expertise in e-commerce taxation can help businesses optimize their tax strategies, minimize liabilities, and stay abreast of the ever-changing regulatory landscape.

With its commitment to excellence and proficiency in navigating the intricacies of tax laws, Make Prep Tax Smart is your partner for businesses seeking comprehensive and tailored solutions. The evolving nature of e-commerce taxation demands proactive and informed approaches, and the expertise of Prep Tax Smart as a CPA ensures that businesses can focus on growth while remaining compliant with the dynamic sales tax environment.